CORNWALL, England – President Joe Biden joined leaders of other leading democracies on the white sands of Carbis Bay, England on Friday, posing for the traditional “family photo” and opening their annual Group of Seven Summit with meetings focused on promoting The world’s focus is on economic recovery from the coronavirus, strengthening democracies, and more decisive action to combat climate change.

The photo marked the official start of the group’s first personal summit since the pandemic began. It’s also the first G-7 after Donald Trump’s tumultuous four years of bickering with longtime allies, pulling the US out of the Paris climate accord and the Iran nuclear deal, and most famously tearing up the communique at the end of 2018 Meeting in Canada despite prior approval. So this meeting offers a chance for a reset and for Biden to show that he means business when he says the US has committed to working with other G7 countries.

In an early win, Biden might have convinced some of the world’s largest economies to raise taxes on companies – but US Congress could be a far tougher sale.

White House press secretary Jen Psaki said Friday that the leaders of the G-7 – which includes the UK, France, Canada, Germany, Italy and Japan – agreed with Biden on a minimum global tax of at least 15% large companies. The G-7 leaders reaffirmed their finance ministers who approved the global tax minimum earlier this month.

[Video not showing up above? Click here to watch » https://www.youtube.com/watch?v=rNk12UM8bQA]

“America is rallying the world to get big multinational corporations to pay their fair share so we can invest in our middle class at home,” said Jake Sullivan, the president’s national security adviser, on Twitter on Friday.

A minimum tax is designed to stop an international race to the bottom in corporate taxation that has led multinational corporations to book their profits in countries with low tax rates. This enables them to avoid taxes and encourages countries to lower tax rates. The minimum rate would make it harder for companies to avoid taxes and could potentially replace a digital services tax that many European nations impose on low-rate US technology firms.

Biden government officials believe that the use of foreign tax havens has deterred companies from investing domestically, costing the middle class. The president hopes that G-7 advocacy can serve as a stepping stone to gain acceptance by the larger group of 20 nations.

The agreement is not a closed agreement as the terms should be agreed by and implemented by the countries of the Organization for Economic Co-operation and Development. The president needs other countries to support a global minimum tax to ensure his own plans for a higher tax in the US don’t harm American businesses.

“It has the potential to stop the race to the bottom,” said Thornton Matheson, a senior fellow at the Tax Policy Center. “It would be a big change in the way things have gone in corporate taxes over the past three decades.”

The idea of an increased global minimum tax is also an integral part of Biden’s domestic agenda, but it is met with opposition in Congress.

The president has proposed using a global minimum tax to fund his comprehensive infrastructure plan. His budget proposal estimates it could raise nearly $ 534 billion over 10 years, but Republicans say the tax law changes would make the United States less competitive in a global economy.

Treasury Secretary Janet Yellen formulated the agreement after the Treasury Ministers’ meeting as fundamental fairness.

“We need stable tax systems that generate sufficient income to invest in essential public goods and respond to crises and ensure that all citizens and businesses share the burden of public finance fairly,” she said.

Texas MP Kevin Brady, top Republican on the House Ways and Means Committee, said GOP lawmakers would fight the tax “tooth and nail”. Republicans see lower taxes as an incentive for businesses to invest and hire, and give little value to Biden’s argument that improved infrastructure and better educated workers would drive more growth.

“It’s an economic surrender,” Brady said on Friday. “President Biden did the impossible – he did better to be a foreign company and a foreign worker than an American company and an American worker.”

Senate Republican chairman Mitch McConnell of Kentucky has repeatedly said his party will oppose any measures that reverse the 2017 tax cuts signed by President Donald Trump.

The 2017 revision created a new way to tax foreign profits of companies on what is known as “global intangible low-taxed income”. The Democrats in Congress said the framework encourages companies to invest abroad rather than domestically.

Biden has proposed increasing this rate to 21%, along with other changes to the Code. The administration regards the 15% of the G-7 as a lower limit rather than an upper limit for tariffs. However, the G-7’s plan deviates from what Biden has proposed and details have yet to be finalized, with tax experts pointing out that there appear to be gaps in the rates and treatment of assets such as buildings and equipment.

Democrats want to grapple with the fine print of any deal before fully agreeing to what comes out of the G-7, which means Biden must continue selling to US voters and their representatives.

Gallery: G-7 summit, June 11th, 2021

[Gallery not loading above? Click here for more photos » arkansasonline.com/612g7/]

The chairman of the Senate Finance Committee, Ron Wyden of Oregon, advocates the general idea of a global minimum tax. But Wyden said in a statement with House Ways and Means Committee chair Richard Neal of Massachusetts that they will have to look at the deal to see if Americans would really benefit from it.

“We are optimistic that a strong multilateral agreement can be reached to harmonize our international tax rules, end the race to the bottom and put a stop to taxes on digital services,” said the two democratic lawmakers. “We look forward to working with the government to evaluate the results of these negotiations for American workers, businesses and taxpayers.”

Information on this article was contributed by Kitty Donaldson and Tim Ross of Bloomberg News (TNS).

President Joe Biden (center) speaks to French President Emmanuel Macron (right) and Italian Prime Minister Mario Draghi after posing for the traditional “family photo” of the Group of Seven on a drizzling beach in Carbis Bay, England on Friday. “I feel like I’m at a wedding,” joked US First Lady Jill Biden as the leaders and their families gathered for the portrait. More photos at arkansasonline.com/612g7/. (AP / Patrick Semansky)

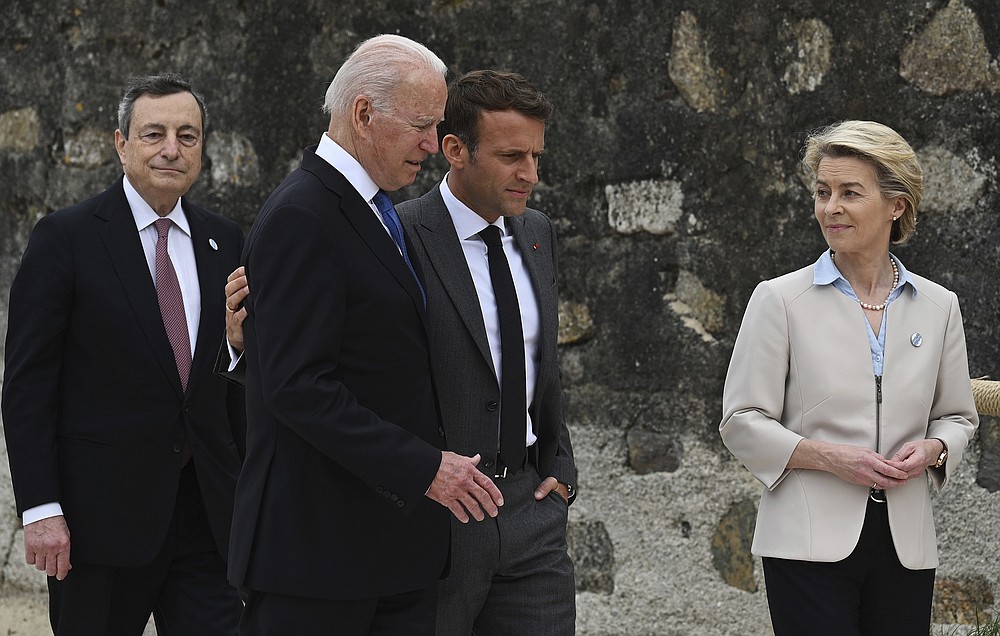

President Joe Biden talks to French President Emmanuel Macron and EU Commission President Ursula von der Leyen after he was invited to the G-7 family photo with guests at the G-7 summit on Friday 11 June 2021 in Carbis Bay, England, has posed. (Kevin Lamarque / Pool via AP)

From left Italian Prime Minister Mario Draghi, US President Joe Biden, French President Emmanuel Macron and European Commission Ursula von der Leyen speak after they came for photos for the official welcome and group photo session of the heads of state and during the G7 summit in Carbis Bay Heads of Government posing, Cornwall, England, Friday 11 June 2021. (Leon Neal / Pool Photo via AP)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JEUL2B5V7BJCFMRTKGOS3ZSN4Y.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DYF5BFEE4JNPJLNCVUO65UKU6U.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UF7R3GWJGNMQBMFSDN7PJNRJ5Y.jpg)